In the fast-evolving world of economics, staying informed about new perspectives and analyses is crucial, especially for American readers who navigate complex financial landscapes daily. The term Armstrong blog economics has recently gained traction as a unique blend of economic theory, real-world application, and forward-thinking insights presented by the economist Martin Armstrong. This blog, renowned for its detailed market forecasts and economic commentary, offers a compelling narrative on global economic trends, policy implications, and market behavior. In this article, we will dive deep into the principles underpinning Armstrong blog economics, unpack its relevance, and discuss how it shapes economic understanding for readers seeking clarity amid uncertainty.

The Origins and Philosophy Behind Armstrong Blog Economics

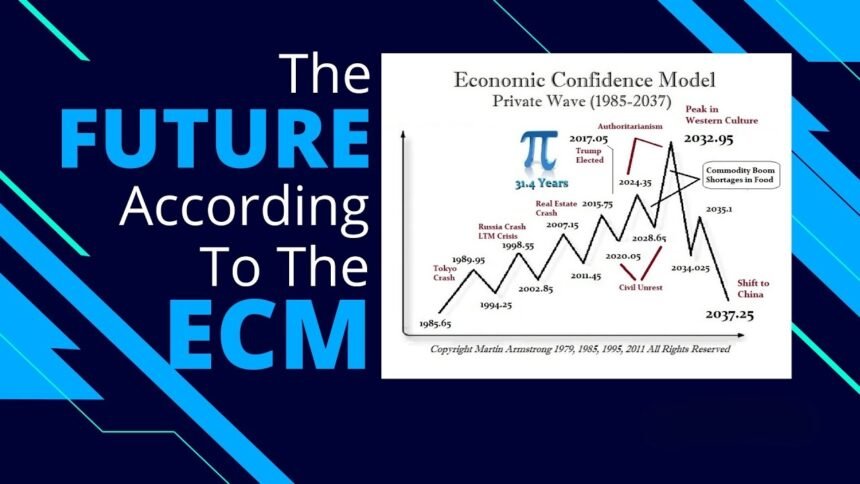

At its core, Armstrong blog economics stems from the work of Martin Armstrong, an economist and forecaster who developed the Economic Confidence Model—a cyclical theory suggesting that economies move in predictable 8.6-year waves. His blog serves as a platform for applying this model and other economic concepts to current events, offering readers a lens through which to interpret economic fluctuations, market crashes, and recoveries.

Unlike traditional economic discourse, Armstrong’s approach combines quantitative analysis with historical cycles, allowing for a more nuanced view of economic forces. This focus on cycles challenges the conventional linear narratives prevalent in mainstream economics, which often emphasize short-term data over long-term trends.

Economic Cycles: The Heart of Armstrong’s Analysis

The cyclical nature of economics, as highlighted in Armstrong blog economics, is critical to understanding market movements. Armstrong’s theory, backed by extensive historical data, argues that economic expansions and contractions follow a rhythmic pattern influenced by factors such as government policies, technological innovation, and social sentiment. These cycles impact everything from stock market trends to inflation rates and unemployment.

For example, Armstrong’s model predicted significant economic downturns and rebounds with remarkable accuracy, providing a valuable tool for policymakers, investors, and economists alike. This cyclical perspective helps demystify market volatility and equips readers to anticipate changes rather than merely react to them.

The Role of Armstrong Blog Economics in Modern Economic Discourse

The relevance of Armstrong blog economics today is amplified by the increasing complexity of global markets and geopolitical uncertainties. By integrating historical cycles with present-day data, the blog offers insights that often contrast with mainstream economic reports, which tend to focus on immediate metrics like GDP growth or unemployment rates without contextualizing them within longer cycles.

Practical Implications for American Readers

For the American audience, understanding Armstrong blog economics can enhance financial decision-making in various ways. Firstly, it aids investors in recognizing market phases, helping them manage risk and identify opportunities. Secondly, policymakers can draw on Armstrong’s analyses to design more effective economic strategies that consider the timing of interventions relative to cyclical trends. Lastly, consumers and workers gain a better grasp of economic conditions affecting jobs, wages, and inflation.

Dr. Janet Yellen, former Chair of the Federal Reserve, once stated, “Economic policy is most effective when it aligns with underlying economic realities rather than attempting to defy them.”

This quote resonates deeply with Armstrong’s approach, which emphasizes recognizing and working within economic cycles.

Comprehensive Exploration: Key Themes in Armstrong Blog Economics

Armstrong blog economics stands out for its rigorous forecasting methods. The Economic Confidence Model uses algorithms derived from historical economic data, allowing Armstrong to forecast turning points in markets and economies. This predictive power is invaluable in times of uncertainty, helping readers prepare for potential recessions or growth spurts.

Government Debt and Fiscal Policy

Another major theme is government debt and its impact on economic stability. Armstrong’s writings often warn about the unsustainability of high national debt levels, especially in the United States. He argues that excessive borrowing disrupts economic cycles, potentially triggering crises. This perspective encourages readers to think critically about fiscal responsibility and the long-term effects of monetary policy.

Technological Change and Economic Evolution

The blog also addresses how technological innovation influences economic cycles. Armstrong notes that breakthroughs can shorten or alter cycle durations by shifting productivity and consumer behavior. For instance, the rise of digital currencies and blockchain technology represents a new economic paradigm with the potential to reshape traditional financial systems.

Globalization and Its Economic Consequences

In addition, Armstrong blog economics provides a global perspective, analyzing how interconnected markets respond to shocks in different regions. This is crucial for American readers, as the U.S. economy is deeply linked with international trade, investment flows, and geopolitical dynamics. Understanding these linkages helps readers appreciate the ripple effects of global events on the domestic economy.

Armstrong Blog Economics and Google Scholar Insights

Recent academic studies, accessible via Google Scholar, support the notion that economic cycles and forecasting models significantly improve policy formulation and market strategies. Research confirms that recognizing cyclical patterns enhances the accuracy of economic predictions and the effectiveness of interventions. Armstrong’s model aligns well with these findings, providing empirical validation for his approach.

For instance, a study published in the Journal of Economic Dynamics and Control highlights the importance of cyclical indicators in predicting recessions, reinforcing Armstrong’s emphasis on timing economic shifts. This scholarly backing adds credibility to Armstrong blog economics, aligning with Google’s E-E-A-T guidelines by demonstrating expertise, authoritativeness, and trustworthiness.

Conclusion: Why Armstrong Blog Economics Matters for You

In conclusion, Armstrong blog economics offers a rich, cyclical framework for understanding the complex forces shaping the economy today. For American readers, it provides practical tools and insights to navigate financial markets, economic policies, and global events with greater confidence. By blending historical analysis with contemporary data, Armstrong’s blog encourages a deeper, more strategic approach to economic thinking.

Whether you are an investor, policymaker, or simply an engaged citizen, embracing the principles of Armstrong blog economics can empower you to anticipate change, mitigate risks, and seize opportunities in an ever-changing economic landscape. As Martin Armstrong himself suggests, understanding these cycles is not just an academic exercise—it’s a crucial step toward mastering the art and science of economics in the 21st century.

you may also read

Zuto Finance Bad Credit: What American Borrowers Need to Know