The tight fiscal policy is a historic retentive attribute in American economic philosophy. It promotes having little government involvement in the economy, reducing national debt, and promoting financial stability in the long term. The philosophy behind this policy is that keeping the costs of the fiscal low is important to the sustainability of the economy as government spending, taxes and the freedom of individuals are major factors that should be taken into consideration. The most important aspect of conservative fiscal policy is its relevancy during this time of economic uncertainty and high levels of debt in the U.S.

This blog will investigate the main principles of conservative fiscal policy, its advantages, and the way it influences the governmental and individual level decisions within the sphere of economics. Understanding the examples of real application and the opinion of experts, we are going to show the importance of this strategy to the success of the country in the long perspectives.

What is the Conservative Fiscal Policy?

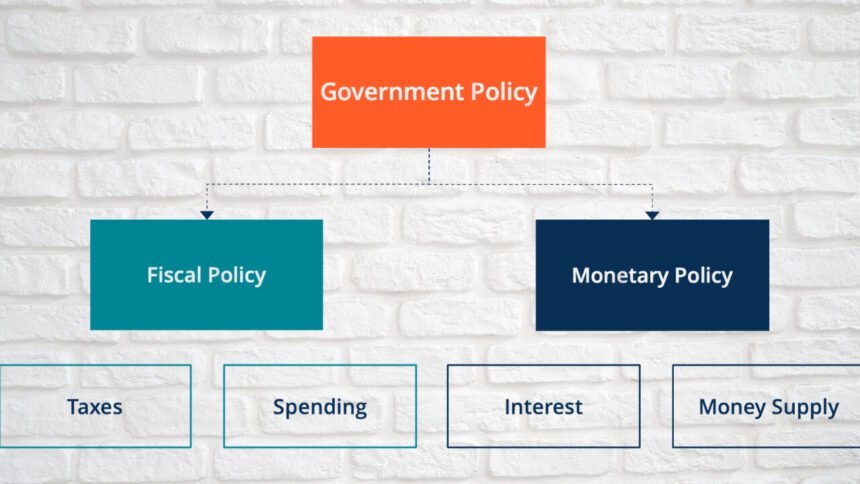

The conservative fiscal policy is also anchored on a number of important principles that focus on stabilizing the economy. Firmly at its core, it pursues to limit the extent of the government to intervene in the market, and at the same time is fiscally responsible. The main target areas of the conservative fiscal policy are:

Controlling Government Spending: Controlling the amount of spending the government does is one of the most significant pillars of the conservative fiscal policy. The advocates state that the high spending by the government may cause inflation, increase in taxes and the national deficit to blow up. Conservative fiscal policy seeks to eliminate unnecessary government expenditures and cut costs on things that may not be important by balancing the federal budget.

Tax Cuts: The conservative fiscal policy is usually characterized by cut through taxes aimed at boosting economic growth. The benefit of lower taxes is that the individual and businesses will have more money to spend and thus invest in productive activities that will result in job creation and wealth generation.

Cleaning up Government Debt: Large national debt can be very costly to the economy of a nation and thus they end up paying high interests and thus fiscal constraints. The further objective of the conservative fiscal policy is to make sure that national debt is lowered gradually so that the economy could be considered healthy and resistant.

Enhancing Economic Freedom: One of the most important aspects of conservative fiscal policy is to believe in free-market economy. With smaller government intervention, more market functionality can be achieved, spurring innovation, competition, and economic growth in terms of employment.

The economic theories that COVID Than Conserving Fiscal Policy

Conservature fiscal is based on classical economics and in particular economists like Adam Smith and Milton Friedman. The invisible hand discussed by Smith intends to clarify that the market is self-regulating whilst monetarism as put by Friedman causes emphasis of regulations established by fiscal and monetary policies on inflation.

Based on these theories the government should do as little as possible and leave the free market to operate itself without any undue interference. This balance is promoted through conservative fiscal policy to consolidate the necessary fiscal choices on economic principles and keep the taxes in perspective.

Advantages of Conservative Finance

A high-level of financial stability in the long-term nature is one of the main advantages of the conservative fiscal policy. Conservative fiscal policy places a high priority on the reduction of deficit and reduction in government spending to make the debts of future generation sustainable. Long-term, this ultimately has the effect of a steadier economy, that has less to do with temporary measures of stimulating the economy, and more to do with market-driven factors.

Promotion of the growth of the private sector

The lower tax rates and government expenditure usually translates into a better environment that the present has to succeed in the business realm. Businesses that do not feel burdened with high taxation and regulations will have higher probabilities of making investments in terms of innovation and expansion and in terms of creation of job opportunity. This in turn creates a more dynamic economy and welcomes competition that can result into better products and services at less cost.

Greater Security in the Economy

The willingness of investors to invest in an economy is higher in the economy that is more fiscally responsible. When government takes a conservative fiscal policy, it gives a market signal that it intends to pay down the debt, and retain an environment with stability. This is able to attract domestic and overseas investment which leads to economic growth and creation of employment.

Emphasis on Sustainable Development

A conservative fiscal policy fosters a long term sustainable growth. Instead of embracing short-term solutions to the problem such as stimulus packages and deficit spending, the policy highlights the status of balanced budgets and phased debt reduction. This is so that growth is not led by unsustainable debt buildup but by the actual productivity and market forces.

Examples of Conservative Fiscal Policy In the Real World

A great example of conservative fiscal policies is the economic policies of President Ronald Reagan that took place in 1980s. The administration of Reagan emphasized on tax cuts, cuts in spending of government and deregulation. These actions brought about economic boom and employment of millions of people.

Nevertheless, the Reagan period was the period of increasing national debt which has been another source of criticism of people who disagree with conservative fiscal policy. However, the overall growth in the economy during this time has shown how conservative fiscal policy can ensure that the economy thrives over the long-run by concentrating on the growth of the private sector and less involvement by the government.

The Bush and Obama Administrations: Two different ways to attack the problem.

The policies of fiscal management differed under the George W. Bush and Barack Obama presidencies. Whereas the Bush administration was also conservative in its fiscal policies especially the tax cuts, the obama administration was more interventionist during the financial crisis, passing through stimulus packages and expansion of government programs.

The difference between the two solutions shows that between having a rigid fiscal policy and the government intervention in times of the economic crisis, there could be tradeoffs. Although the conservatism fiscal policy focuses on long-term stability, interventionism fiscal policy can bring relief especially during economic downturns.

Recent Developments The Trump Administration

The conservative fiscal policy was back in the limelight under President Donald Trump. The Trump administration supported massive tax cutting and tried to deregulate various sectors in the economy with an aim of promoting economic growth. The aim of these measures was to cut down on the taxes paid by entrepreneurs and individuals hence creating a more vibrant economy.

Nonetheless, similar to the fiscal policies of Reagan, the fiscal policy of Trump did experience increases in national debt, which prompted arguments in support of or against the state of deficit spending as against tax cuts. Critics believed that the tax cuts mainly favored the rich and businesses, whereas those that supported the measure were of the view that the policy boosted the economy and increased employment.

The problems of conservative fiscal policy The most significant problem of the conservative fiscal policy was that it tried to implement a fiscal solution to an economic problem.

Dangers of decreasing provision of services to the people

Among some of the obstacles that are associated with conservative fiscal policy entails the possibility of a decline in public services. Although some people support this, saying that government needs to cut spending to have a sustainable economy, critics say that this may destroy services provided which include education, social security and even healthcare. These services are very important to the care of vulnerable groups and any downsizing may end up increasing inequality.

The Problem of Income Distribution

The next criticism of conservative fiscal policy is that it can increase income inequality. Opponents of the policy say that by reducing the amount of tax paid by business and the wealthy it gives it all to the already wealthy members of the society leaving the lower earning earners with little to take care of themselves. This may end up in a growing wealth gap that results in social and political instability.

Economic InstabilityRisk of Economic instability

You know, even though conservative fiscal policy is directed towards long-term stability, its short-term effects can be quite problematic. As an illustration, the premature moves to cut the spending can drastically reduce the economic activity, and the decrease of the governmental support of such branches of the economy like healthcare or education can create the waves of the dissatisfaction among the populace. Finding the right equilibrium between the financial tightening and required expenditure by the government is always a challenge.

Professional View on Conservative Fiscal Policy

Economist John Taylor of the Stanford University believes a conservative fiscal policy is crucial to the long-run economic growth. The dinners went off with a touch of prosperity, and the freighters were pretty agreeable, considering how much money they charged, at least under the management of the gentlemen that went with you, out of whose side-pockets they used to remove a moderate advance towards the expenses of the dinner, as well as towards a pick-me-up store such as had been followed in the olden days: a little gift, a collar-pin, cuff-link, or a pencil, and some other assorted trifle; this much in cash, with a valet that would take a holiday-

Fiscal discipline and efforts to ensure reduction in the national debt is what will ensure that the economy is stable. In their absence, we jeopardize the entire roots of a free-market economy.”

His ideas accentuate the importance of a conservative fiscal policy in establishing conditions that can produce prolonged growth and a decrease in dependence on governmental interventions.

What is in the Future of the Conservatism of Fiscal Policy?

One of the effective measures that can be taken in strengthening the long-term economic stability and the reduction of debt owned by governments, as well as encouraging the development of the private sector is the conservative fiscal policy. Although it does indeed pose problems, including the possibility of drop in the number of services available to the population and growth of income inequality, financial prudence and sustainable development are key issues in the future of the country economy.

With the challenges of running a contemporary economy, it is evident that the conservative fiscal policy will remain a major tool in the development of the economic direction of America. Conservative fiscal policy is a guide to a stable and prosperous future through reducing the amount of government spending, minimizing taxes, and economic freedom.

Here, we talked about the essence of conservative fiscal policy, its advantages, world implementations and the issue it raises. The grasping of the factors can enable the readers to comprehend more on the significance of such a policy approach in defining the economic landscape of America.

you may also like

Robert and Rorie: A Friendship, a Flurry of Triangles and Tribulations