Economic profit is a term that regularly sparks debates in business, economics, and finance discussions. It’s an idea that not only measures the monetary performance of a company but also plays a crucial role in shaping business strategies and decisions. Unlike simple accounting profit, which only considers revenue minus explicit costs, economic profit takes into account both explicit and implicit costs, offering a more comprehensive perspective on profitability. For anyone looking to understand the mechanics behind business success, it’s essential to comprehend the concept of economic profit. In this blog post, we will dive into what economic profit is, how it’s calculated, its impact on businesses and the broader economy, and why it matters to entrepreneurs, investors, and policymakers alike.

What Is Economic Profit?

At its core, economic profit refers to the difference between a company’s total revenue and the sum of its explicit and implicit costs. Explicit costs are those out-of-pocket costs that a company incurs, such as wages, rent, and materials. Implicit costs, on the other hand, represent the opportunity costs of the resources used, including the income an entrepreneur could have earned if they chose to use their resources elsewhere.

This is different from accounting profit, which only considers explicit costs. Therefore, a company can show a positive accounting profit while incurring an economic loss, highlighting the crucial difference between these two types of profit. For example, if a business owner earns $100,000 in revenue, but the explicit costs are $60,000, the accounting profit would be $40,000. However, if the owner could have earned $50,000 working for another company, the economic profit would be a loss of $10,000, as the implicit cost of the business owner’s time and skills is higher than the revenue generated.

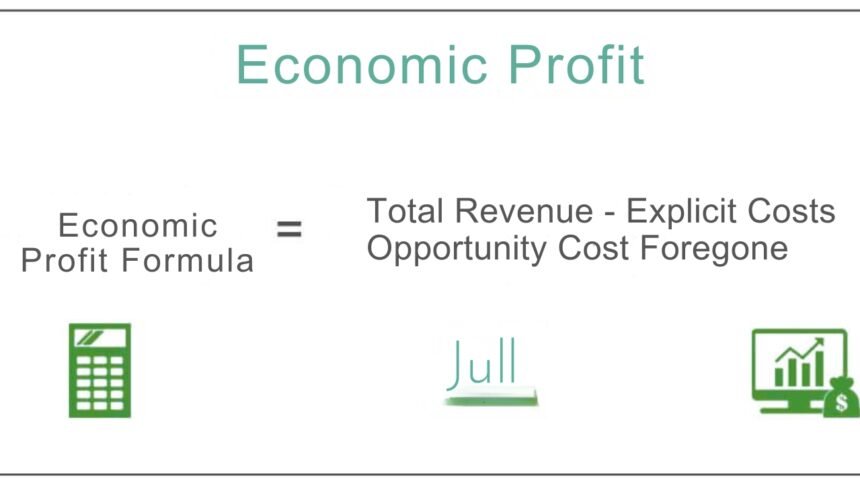

The Formula for Calculating Economic Profit

The formula for calculating economic profit is relatively simple but requires a nuanced understanding of both explicit and implicit costs.Economic Profit=Total Revenue−(Explicit Costs+Implicit Costs)\text{Economic Profit} = \text{Total Revenue} – (\text{Explicit Costs} + \text{Implicit Costs})Economic Profit=Total Revenue−(Explicit Costs+Implicit Costs)

Where:

- Total Revenue refers to all the income the business generates from its sales or services.

- Explicit Costs are the tangible, out-of-pocket expenses.

- Implicit Costs represent the opportunity costs, such as the income the owner forgoes by investing time and resources into the business.

Let’s take a closer look at how each of these elements plays into the overall financial health of a business.

Why Does Economic Profit Matter?

Economic profit plays an essential role in determining the long-term viability of a business. When businesses consistently generate positive economic profits, they signal that they are creating value beyond just covering their costs. A positive economic profit indicates that a business is not only covering its operational expenses but also providing returns that exceed the opportunity costs of the resources employed.

In contrast, a company that generates zero or negative economic profit is either not maximizing its resources or is operating in an inefficient market. For entrepreneurs, this can serve as a warning sign that their business model may need to be adjusted. For investors, it’s a critical metric when evaluating the financial health and potential of a business.

As economist David Ricardo once said, “Profit is the reward for the use of capital and the exertion of labor.” In the context of economic profit, this means that businesses are incentivized to create products and services that maximize value, not just generate revenue.

How Economic Profit Affects Decision-Making in Business

For businesses, the calculation of economic profit is central to decision-making. Whether a company is considering expansion, launching new products, or making cuts to its operations, understanding the concept of economic profit helps in evaluating the potential outcomes of these decisions.

Profit Maximization

Businesses often seek to maximize their economic profits, which requires them to carefully analyze both their revenues and costs. By doing so, they can make informed decisions about pricing, resource allocation, and market positioning. For example, if the cost of manufacturing a product exceeds its selling price after considering implicit costs, then the business may decide to scale back production or change its pricing strategy.

Strategic Adjustments

In a competitive market, businesses continuously evaluate whether they are achieving economic profit. If a company finds itself consistently operating at a loss, it may need to reassess its strategy. This could include entering new markets, refining its product offerings, or negotiating better deals with suppliers. On the other hand, a business generating significant economic profit may choose to reinvest those profits into further growth opportunities, such as acquisitions or technological advancements.

Economic Profit and Market Efficiency

Economic profit also plays a vital role in the efficiency of markets. In competitive industries, businesses that generate positive economic profits signal to other firms that there is potential for reward in the market. This attracts new entrants and drives innovation, as firms strive to capture a piece of the market by offering better products or services.

However, when a market is monopolistic or lacks competition, the generation of economic profit may indicate inefficiencies. In such cases, businesses may not have the same incentives to innovate or reduce costs, which can ultimately harm consumers and stifle economic growth.

The existence of economic profit in a competitive market helps to allocate resources efficiently, ensuring that the best-performing firms thrive while those that are less efficient exit the market.

The Role of Economic Profit in Shaping Public Policy

Economic profit is not just important for individual businesses; it also has broader implications for public policy. Policymakers often look at economic profit when considering regulations and taxes. For instance, high economic profits in certain industries may prompt government intervention to ensure that companies are not exploiting consumers or distorting market dynamics.

Furthermore, understanding the levels of economic profit across different sectors can help policymakers assess whether the market is functioning efficiently or if monopolies or oligopolies are hindering competition. Governments may use this information to introduce antitrust laws or other regulatory measures to maintain fair competition.

Economic Profit vs. Accounting Profit: Key Differences

It’s important to highlight the differences between economic profit and accounting profit. The primary distinction lies in the inclusion of opportunity costs in economic profit calculations. Here’s a breakdown of these differences:

- Accounting Profit: This is the simple profit that businesses report in their financial statements. It is calculated by subtracting explicit costs from total revenue. It does not consider opportunity costs or the cost of foregone alternatives.

- Economic Profit: This takes into account both explicit and implicit costs, including the opportunity costs of resources used in the business. Economic profit provides a more accurate picture of a company’s true financial performance, particularly for long-term sustainability.

While accounting profit is crucial for reporting to shareholders and regulatory authorities, economic profit provides a more comprehensive view of a business’s performance.

Conclusion

Economic profit is a powerful tool that reveals the true profitability of a business by considering both explicit and implicit costs. Unlike accounting profit, which provides a limited snapshot, economic profit offers a deeper understanding of whether a company is truly creating value. For entrepreneurs, investors, and policymakers, grasping the concept of economic profit is essential for making informed decisions that ensure the long-term success and sustainability of businesses and industries. As markets continue to evolve, understanding economic profit will remain a key indicator of business health and a driver of economic growth. By carefully analyzing economic profit, businesses can better allocate resources, adjust strategies, and contribute to a more efficient and competitive economy.