ent Matters More Than Ever

In today’s fast-paced world, money management has become an essential skill for American adults seeking financial stability and freedom. With the rise of digital spending, fluctuating economies, and mounting debts, managing personal finances effectively is no longer optional—it’s crucial. Understanding how to budget wisely, save consistently, and invest prudently can transform your financial life, reduce stress, and secure your future. This blog explores practical strategies and insights into money management, designed to empower you with knowledge and confidence.

The Foundations of Money Management

The first step in effective money management is gaining a clear picture of your current financial status. This involves tracking your income, expenses, debts, and savings. Many Americans struggle because they lack awareness of where their money goes each month. To avoid this pitfall, start by creating a detailed budget that lists all sources of income alongside fixed and variable expenses.

By doing so, you can identify unnecessary spending and areas for improvement. Research published in the Journal of Financial Planning highlights that people who maintain budgets tend to have higher savings rates and lower levels of debt. Thus, budgeting is not just a mundane task but a cornerstone of sound money management.

The Importance of Emergency Funds

Unexpected expenses can quickly derail your financial plans. Hence, building an emergency fund should be a priority. Ideally, this fund should cover three to six months of living expenses, providing a safety net for job loss, medical emergencies, or urgent home repairs. According to Suze Orman, a renowned personal finance expert,

“An emergency fund is the cornerstone of financial security—it protects you from the unexpected and helps you sleep better at night.”

Having this fund ensures you avoid high-interest debt, such as credit card balances, which often become a financial trap. The discipline to set aside money regularly—even if it’s a small amount—reinforces good money management habits.

Advanced Money Management Strategies

Managing debt effectively is a critical aspect of money management. High-interest debts, particularly credit card debt, can severely impact your financial health. The key is to prioritize paying down debts with the highest interest rates first while maintaining minimum payments on others, a method known as the “avalanche” technique.

Another strategy is refinancing loans to secure lower interest rates, which can reduce monthly payments and total interest paid over time. Combining these approaches requires discipline but pays off significantly in long-term savings.

Investing Wisely for the Future

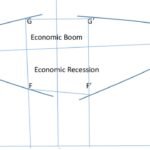

Beyond saving, investing is crucial for growing your wealth and securing retirement. However, many Americans hesitate due to the complexity and perceived risks. Money management includes educating yourself about different investment vehicles such as stocks, bonds, mutual funds, and retirement accounts like 401(k)s and IRAs.

A balanced investment portfolio tailored to your risk tolerance and financial goals helps you build wealth over time. Studies from The Journal of Behavioral Finance suggest that investors who diversify their portfolios and remain patient during market fluctuations tend to achieve better outcomes.

Technology’s Role in Modern Money Management

In the digital age, numerous apps and online platforms can simplify money management. Tools like budgeting apps, expense trackers, and automated savings programs can help monitor spending, set financial goals, and invest with minimal effort.

These technologies offer real-time insights and personalized advice, making it easier to stick to budgets and avoid overspending. Integrating these tools into your daily routine can enhance financial discipline and awareness.

The Rise of Digital Banking and Payment Systems

Digital banking and mobile payment systems have revolutionized how we manage money. They offer convenience, instant transactions, and easy access to financial information. However, they also require vigilance against fraud and overspending.

Good money management now includes setting alerts, using strong passwords, and regularly reviewing accounts for unauthorized transactions. As financial expert Dave Ramsey points out,

“Technology is a double-edged sword—it can either empower your money management or sabotage it if not used wisely.”

Psychological Factors in Money Management

Money management is not just about numbers but also about behavior. Emotional spending—buying to cope with stress, boredom, or social pressure—can sabotage your finances. Recognizing triggers and practicing mindful spending are vital skills.

Techniques such as delaying purchases, setting spending limits, and focusing on financial goals help curb impulsive buying. This psychological awareness reinforces a healthier relationship with money and supports long-term financial success.

Building Financial Confidence and Literacy

Financial literacy is a continuous journey. The more you learn about personal finance, the more confident and competent you become. Engaging with books, podcasts, workshops, and scholarly articles deepens your understanding.

This empowerment encourages better decision-making, reduces anxiety about money, and fosters habits that contribute to sustainable money management. Educational resources aligned with credible research, like those found on Google Scholar, provide valuable, evidence-based knowledge.

Conclusion: Embracing Money Management for a Brighter Financial Future

Mastering money management is a vital step toward achieving financial independence and peace of mind. By understanding your financial situation, managing debt responsibly, investing wisely, and embracing technology, you can build a robust financial foundation. Moreover, addressing the psychological aspects of spending and continuously improving your financial literacy will empower you to make smarter decisions.

Remember, money management is a lifelong commitment, not a one-time fix. As you practice these strategies, you’ll find that controlling your finances is not only possible but also deeply rewarding. Start today, and take charge of your financial destiny with confidence and clarity.

If you want, I can help you practice using idioms and advanced vocabulary to discuss money management as well. Would you like that?