The topic of “Trump tariffs explained” has become a cornerstone in understanding recent shifts in U.S. trade policy and their broad-reaching economic effects. Tariffs imposed by former President Donald Trump have sparked considerable debate among economists, policymakers, and American consumers alike. These tariffs were aimed at protecting American industries, addressing perceived unfair trade practices, and recalibrating U.S. global trade relationships. However, the outcomes have been complex and multifaceted, impacting everything from manufacturing jobs to consumer prices and international diplomacy.

Introduction to Trump Tariffs Explained

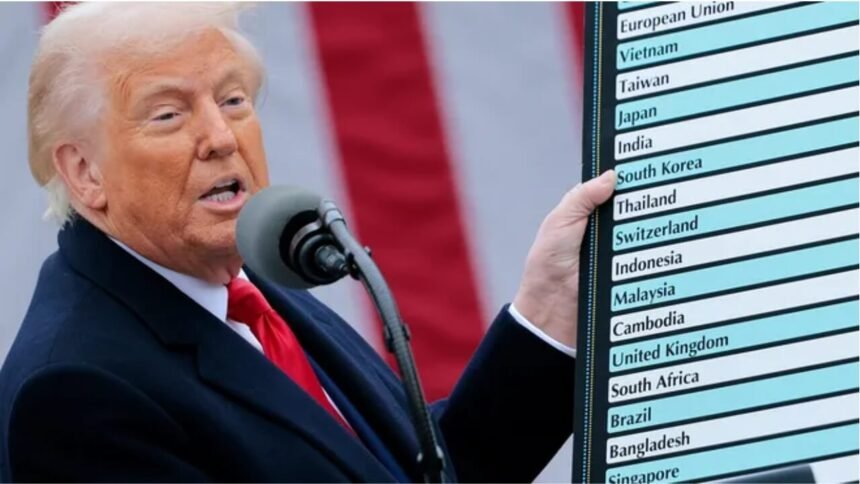

At its core, “trump tariffs explained” involves grasping the tax system on imports that Trump aggressively expanded during his presidency. Tariffs are essentially taxes imposed on imported goods and services, designed to make foreign products more expensive and, in theory, encourage consumers to buy domestic goods. Trump’s aggressive tariff policies targeted major trading partners like China, Canada, Mexico, and the European Union, aiming to reduce trade deficits and protect American manufacturing. But as critics and experts emphasize, the implications go far beyond simple protectionism—they affect everything from inflation rates and supply chains to diplomatic relationships and economic growth. Today, understanding these tariffs helps Americans navigate the ongoing economic landscape shaped by these policies.

The Rationale Behind Trump’s Tariffs

Trump’s administration defended tariffs as a tool to correct trade imbalances that had, in their view, disadvantaged American workers and industries. The U.S. had experienced a persistent trade deficit, importing far more goods than it exported, especially from countries like China. The tariffs sought to curb this imbalance by imposing higher costs on imports, with the expectation that this would boost domestic manufacturing jobs and encourage companies to relocate production back to the United States.

Moreover, the tariffs were intended to combat intellectual property theft and unfair trade practices, such as subsidies to foreign companies and dumping products at below-market prices. By imposing significant tariffs—looking particularly at steel, aluminum, and a broad range of Chinese goods—the administration aimed to gain leverage in trade negotiations and prompt other countries to revise their policies.

However, despite these intentions, many economists have highlighted that such strategies come with trade-offs. Joseph Stiglitz, Nobel laureate and Columbia University economist, remarked, “Virtually all economists think that the impact of the tariffs will be very bad for America and for the world. They will almost surely be inflationary.” His statement reflects widespread concern about the tariffs’ repercussions on the broader economy, including rising consumer prices and disrupted supply chains.

The Economic Impact of Trump Tariffs Explained

The tariffs imposed by Trump were far-reaching, with steel and aluminum subjected to 25% duties, and some Chinese imports facing rates as high as 145%, the highest tariff rate among developed nations according to Fitch Ratings. This has led to several immediate and longer-term effects on the U.S. economy.

First, the direct impact on consumer prices has been significant. Since tariffs increase the cost of imported goods, these costs often get passed on to American consumers. Product categories ranging from electronics to vehicles have seen price increases, contributing to inflationary pressure in an already complex economic environment. Businesses importing components or finished goods face higher input costs, often compelling them to raise prices or absorb losses.

Second, contrary to the protective intent, tariffs can disrupt domestic manufacturing. Many U.S. manufacturers rely on global supply chains, importing parts and raw materials that are essential for production. Tariffs increase costs at multiple points in these supply chains, reducing efficiency and competitiveness. “The tariffs would apply each time parts cross the border,” noted trade experts, “that 25 percent would be compounded on each step,” significantly raising costs.

Additionally, retaliatory tariffs from trading partners have hit sensitive U.S. sectors, particularly agriculture, where exports like soybeans and pork have faced trade barriers, impacting farmers directly. Moreover, uncertainties surrounding tariffs have caused businesses to delay investment and hiring decisions, impacting economic growth and job creation.

The Global Response and Trade Relations

Trump’s tariffs were not imposed in a vacuum; they triggered significant international pushback. Countries targeted by U.S. tariffs have responded with retaliatory measures of their own, imposing tariffs on American goods—a move that escalated tensions and led to a series of trade disputes often described as a “trade war,” particularly with China.

These retaliatory tariffs hurt U.S. exporters and introduced volatility into global markets. Many experts warned that this back-and-forth could lead to broader economic slowdown and fractured trade alliances. Countries like Canada and Mexico, traditionally strong trade partners, were caught in the crossfire, affecting industries reliant on integrated supply chains.

The World Trade Organization (WTO) has struggled to mediate in these disputes effectively, as countries increasingly turn to unilateral measures rather than multilateral negotiations. Trump’s tariffs challenged previous norms of global trade, raising questions about the future of international trade cooperation.

Who Benefits and Who Loses?

While tariffs were framed as a tool to protect American workers, the reality is nuanced. Some domestic industries, such as U.S. steel producers, saw benefits from reduced foreign competition and increased production. Jobs in these sectors received a boost, albeit limited by the overall market size.

However, the broader consumer base and many manufacturing sectors suffered. Increased costs of imported goods meant that American families spent more on everyday products. Small businesses reliant on imports faced higher costs, shrinking profit margins or requiring price hikes that could dampen sales.

Economists broadly agree that tariffs, while intended to revive certain industries, tend to harm economic efficiency and reduce competitiveness. “What we found is it actually tends to have the opposite effect. It tends to damage the industrial sector by decreasing efficiency in production relative to other countries,” noted economists analyzing trade data.

Trump Tariffs Explained: Expert Insights

Trade policy experts provide critical perspectives on the tariff strategy. For instance, Cornell University trade policy expert Eswar Prasad warned of the tariffs’ broader implications: “U.S. exporters will face a particularly tough time, as they are likely to face rising tariff barriers in their foreign markets. In addition, tariffs are likely to drive up the dollar and reduce the competitiveness of their exports in global markets”. This view underscores how tariffs can create a ripple effect, adversely affecting America’s position in global trade.

Conclusion: Understanding the Complex Legacy of Trump Tariffs

In summary, “trump tariffs explained” is a crucial topic for understanding modern American economic policy, especially for American audiences seeking to grasp how these measures impact their lives and the economy. The tariffs were designed with the intention of protecting American jobs, reducing trade deficits, and punishing unfair trade practices. Yet, the outcomes have been mixed — benefiting select industries while inflating consumer costs, disrupting supply chains, and provoking retaliatory trade actions worldwide.

The full economic story of Trump’s tariffs reflects the complexity of globalized trade and the challenge of balancing national interests with international cooperation. As the U.S. continues to navigate trade policy in a changing global landscape, reflecting on these tariffs offers valuable insights into the potential benefits and risks of protectionism in the 21st century. Thoughtful engagement with this topic can help Americans better appreciate the intricate interplay between trade policy, economic welfare, and global diplomacy.

you may also like

Inchoate Crimes: Understanding the Law of Incomplete Offenses in America