An economic boom is a powerful and often exhilarating phase in the cycle of any nation’s economy, marked by rapid growth, soaring employment, and rising incomes. In the United States, an economic boom captures the imagination because it promises prosperity for businesses and individuals alike. But what exactly triggers this phenomenon, and how can we recognize its intricate dynamics? This blog delves deep into the forces behind an economic boom, exploring its causes, impacts, and the challenges it presents, especially for an American audience eager to understand the shifts shaping their financial landscape.

Understanding the Fundamentals of an Economic Boom

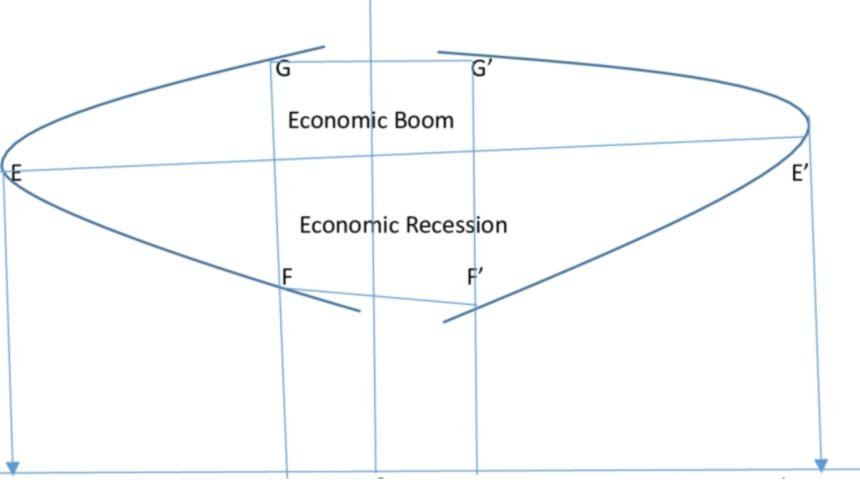

An economic boom is typically characterized by increased consumer spending, business investments, and heightened production activity. When demand for goods and services accelerates, companies respond by expanding operations, hiring more employees, and often introducing new innovations. This upward spiral, however, is not spontaneous. It usually follows a period of economic stability, favorable government policies, and positive consumer confidence.

From a scholarly perspective, studies from Google Scholar emphasize that economic booms often arise due to a combination of monetary policy easing, technological advancements, and global trade expansion. For example, the post-World War II American boom was fueled by technological innovation and increased consumer demand as soldiers returned home, ready to build families and buy homes.

Furthermore, economists highlight the role of credit availability during these phases. Easier access to credit for both consumers and businesses often ignites spending and investments, adding fuel to the boom. This makes fiscal policy an essential tool for governments aiming to sustain or moderate such growth phases.

The Economic Boom in the Context of America’s Recent History

Looking at recent decades, the American economy has experienced several boom periods, each shaped by unique factors. The late 1990s, for instance, saw a significant economic boom powered by the rise of the internet and the tech industry. This boom was characterized by soaring stock markets, high employment rates, and widespread optimism about future growth.

In contrast, the mid-2000s economic boom was driven largely by real estate and financial market expansions. Easy mortgage lending and speculative investments led to a surge in housing prices, which eventually culminated in the 2008 financial crisis. This boom-bust cycle underscores the delicate balance governments and markets must maintain to prevent overheating and collapse.

Moreover, the COVID-19 pandemic ushered in a unique boom during the recovery phase, with massive fiscal stimulus, low-interest rates, and pent-up consumer demand sparking rapid growth. This recent boom, however, has been accompanied by inflationary pressures and supply chain disruptions, reminding us that economic booms can also bring new challenges.

Key Drivers of an Economic Boom

Several interlinked factors typically drive an economic boom. First, consumer confidence plays a pivotal role; when people feel secure in their jobs and finances, they spend more freely. This increased demand stimulates businesses to ramp up production and hiring, creating a positive feedback loop.

Second, government policies including tax cuts, stimulus packages, and deregulation often set the stage for economic expansion. By lowering barriers for businesses and increasing disposable income for consumers, such policies can ignite growth.

Third, technological innovation continually reshapes industries, making production more efficient and creating new markets. From the industrial revolution to the digital age, technology has consistently been a key boom catalyst.

Fourth, globalization and international trade open new avenues for growth by expanding markets and allowing specialization. American companies benefit from exporting goods and importing cheaper materials, which supports higher productivity and profits.

Lastly, monetary policy by the Federal Reserve influences interest rates and credit availability, affecting borrowing and spending patterns. Low-interest rates typically encourage investment and consumption, accelerating economic expansion.

The Expert Viewpoint: Insights on Economic Booms

Economist Dr. Janet Yellen, former Chair of the Federal Reserve, once remarked,

“Economic booms are periods of exuberance but must be managed with prudence to ensure sustainable growth.”

Her statement encapsulates the complexity of booms — they bring opportunities but also risks like inflation and asset bubbles.

This expert insight highlights the importance of balanced policymaking that supports growth without allowing economic overheating. Oversight and regulation during booms can prevent the formation of unsustainable debts and speculative bubbles that jeopardize long-term stability.

Challenges and Risks During an Economic Boom

While an economic boom is often celebrated, it comes with inherent challenges. Inflation is a common issue, as rising demand pushes prices higher, eroding purchasing power. If wages do not keep pace, inequality can widen, causing social and economic tensions.

Additionally, rapid expansion can lead to labor shortages, driving up wages and operational costs for businesses. Sometimes, this pressure forces companies to cut back or automate, which may disrupt job markets.

Asset bubbles—such as those in housing or stock markets—are another danger. When prices detach from underlying values, crashes become more likely, leading to recessions that can negate boom gains.

Furthermore, environmental sustainability is often overlooked during booms, as increased industrial activity can strain natural resources and contribute to pollution.

How Americans Can Navigate an Economic Boom

For individuals and families, understanding the phases of an economic boom can guide financial decisions. During boom periods, investing in stocks, real estate, and skills development often yields higher returns. However, it’s also crucial to prepare for potential downturns by maintaining emergency savings and avoiding excessive debt.

For business owners, leveraging growth opportunities through innovation and expansion while managing risks prudently is essential. Maintaining strong balance sheets and flexible strategies can help weather any future corrections.

Policymakers face the ongoing task of balancing growth with stability, ensuring that booms lead to broad-based prosperity rather than sharp inequalities or market distortions.

Conclusion: Embracing the Cycle of Growth

An economic boom, especially in the context of America’s dynamic economy, is a multifaceted phenomenon marked by opportunity and complexity. By understanding its drivers—consumer confidence, government policy, technological innovation, globalization, and monetary policy—Americans can better prepare to harness its benefits while managing its risks.

As history shows, economic booms are not merely periods of luck but the result of intricate interactions between markets, policies, and societal behaviors. With careful stewardship and informed decisions, an economic boom can be more than just a fleeting moment; it can lay the foundation for sustainable prosperity.

Understanding the nuances of an economic boom empowers individuals, businesses, and policymakers to ride the wave wisely, ensuring that growth leads to enduring economic well-being for all Americans.